In the realm of financial planning, Individual Retirement Accounts (IRAs) stand as cornerstone tools for securing one’s future financial well-being. Among the various IRA options available, Roth IRAs and traditional IRAs have garnered significant attention for their distinct tax advantages and contribution rules. While both types of IRAs offer attractive benefits for retirement savings, they cater to different financial goals and circumstances.

Understanding Traditional IRAs: Tax Benefits Upfront

Traditional IRAs provide upfront tax benefits by allowing individuals to deduct their contributions from their taxable income in the year they are made. This deduction can significantly reduce one’s tax liability, particularly for those in higher tax brackets. However, upon retirement and withdrawals, the funds are taxed as ordinary income.

Unveiling Roth IRAs: Tax Implications Deferred

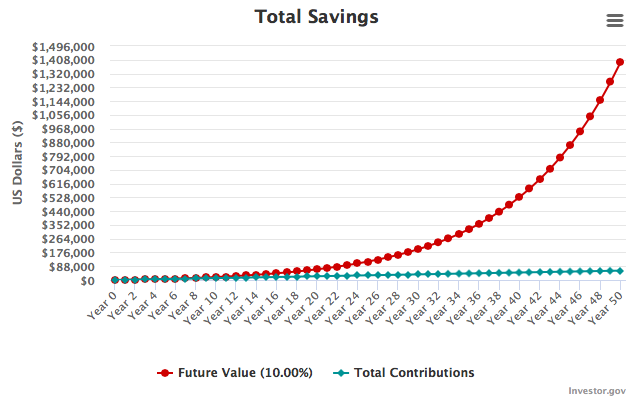

Roth IRAs, in contrast, differ in their tax treatment. Contributions to Roth IRAs are made with after-tax dollars, meaning they do not provide immediate tax deductions. However, the funds grow tax-free within the account, and qualified withdrawals in retirement are completely tax-free. This tax-free aspect makes Roth IRAs particularly appealing for those who expect to be in a higher tax bracket during retirement.

Comparing the Key Distinctions

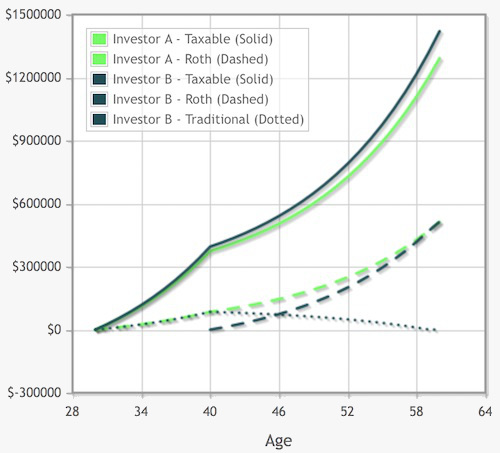

The primary distinction between traditional IRAs and Roth IRAs lies in their timing of tax benefits. Traditional IRAs offer upfront tax deductions but tax withdrawals in retirement, while Roth IRAs defer tax implications until retirement, allowing for tax-free withdrawals. Additionally, contribution limits and income restrictions vary between the two types of IRAs.

Contribution Limits and Income Restrictions

The annual contribution limits for both traditional IRAs and Roth IRAs remain the same in 2023, set at $6,000 for individuals under age 50 and $7,000 for those over 50. However, income restrictions apply to Roth IRA contributions. For single filers, the ability to make full Roth IRA contributions phases out between a Modified Adjusted Gross Income (MAGI) of $125,000 and $140,000, while for married couples filing jointly, the phase-out range is between $204,000 and $224,000.

Choosing the Right IRA: Aligning with Financial Goals

The choice between a traditional IRA and a Roth IRA depends on individual financial goals, tax brackets, and expected income levels in retirement. For those seeking upfront tax deductions and expecting to be in a lower tax bracket during retirement, a traditional IRA may be a suitable choice. However, for those anticipating a higher tax bracket in retirement and prioritizing tax-free withdrawals, a Roth IRA proves more advantageous.

Consulting with Financial Professionals

Given the complexities of tax implications and retirement planning, consulting with a financial advisor can prove invaluable in making informed decisions regarding traditional IRAs and Roth IRAs. Financial advisors can assess individual circumstances, project future tax brackets, and guide individuals towards the IRA option that best aligns with their long-term financial goals.

Conclusion: Navigating the Road to Retirement

Traditional IRAs and Roth IRAs offer powerful tools for securing financial stability and achieving retirement goals. By understanding their distinct tax advantages, contribution limits, and income restrictions, individuals can make informed decisions that align with their unique financial circumstances and aspirations. Whether opting for upfront tax benefits or tax-free withdrawals in retirement, both traditional IRAs and Roth IRAs play crucial roles in building a secure and fulfilling financial future.