RBL Bank offers a variety of credit cards to suit different needs and budgets. Some of the most popular RBL credit cards include:

RBL Platinum Maxima Plus Credit Card: This card offers a number of benefits, including a welcome gift of 5,000 reward points, 5x reward points on travel spends, and a low annual fee of Rs. 999 (plus GST).

RBL Icon Credit Card: This card is designed for frequent travelers, with a welcome gift of 10,000 reward points, 10x reward points on international travel spends, and a free airport lounge membership.

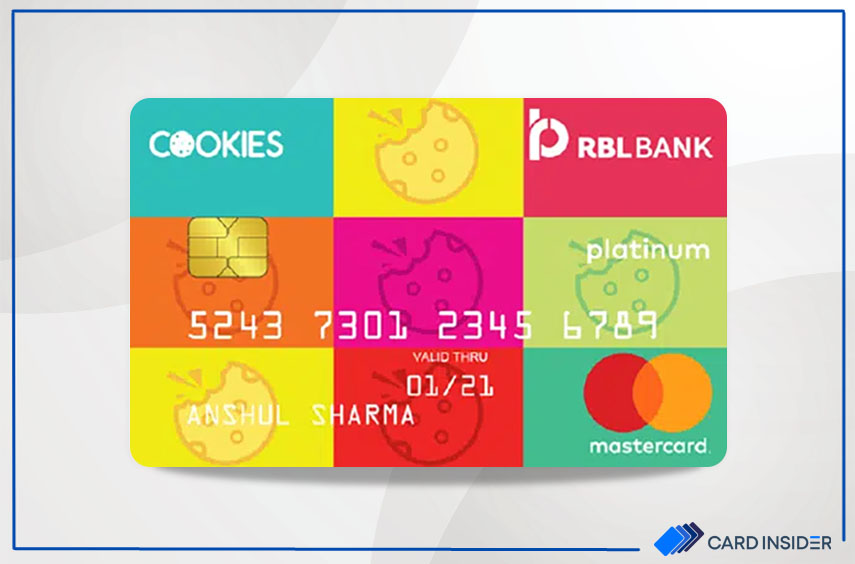

RBL Cookies Credit Card: This card is perfect for foodies, with a welcome gift of 3,000 reward points, 5x reward points on dining spends, and a complimentary dessert at select restaurants.

RBL ShopRite Credit Card: This card offers a number of benefits for shoppers, including a welcome gift of 1,000 reward points, 5x reward points on grocery spends, and a 5% discount at select supermarkets.

RBL World Safari Credit Card: This card is designed for travelers, with a welcome gift of 3,000 reward points, 5x reward points on travel spends, and a 0% markup fee on all foreign transactions.

RBL Credit Card Charges

RBL Bank charges a variety of fees for its credit cards, including:

- Annual fee: Most RBL credit cards have an annual fee, which is typically charged once per year.

- Joining fee: Some RBL credit cards have a joining fee, which is typically charged once when you open the card.

- Late payment fee: If you make a late payment on your RBL credit card, you will be charged a late payment fee.

- Foreign transaction fee: If you use your RBL credit card to make a purchase outside of India, you will be charged a foreign transaction fee.

- Balance transfer fee: If you transfer a balance from another credit card to your RBL credit card, you will be charged a balance transfer fee.

How to Apply for an RBL Credit Card

To apply for an RBL credit card, you can visit the RBL Bank website or visit a branch of RBL Bank. You will need to provide your personal information, income documentation, and employment information. RBL Bank will then review your application and let you know if you have been approved.

RBL Credit Card Benefits

RBL credit cards offer a number of benefits, including:

- Reward points: Most RBL credit cards earn reward points, which can be redeemed for travel, merchandise, and other rewards.

- Cashback: Some RBL credit cards offer cashback rewards, which can be redeemed for cash.

- Discounts: Some RBL credit cards offer discounts at select merchants.

- Insurance: Some RBL credit cards offer travel insurance and other types of insurance.

RBL Credit Card Customer Service

If you have any questions about your RBL credit card, you can contact RBL Bank customer service by phone, email, or chat.

Conclusion

RBL Bank offers a variety of credit cards to suit different needs and budgets. With its many benefits, RBL credit card can be a great way to save money, earn rewards, and protect your purchases.

Additional Resources

- RBL Bank website: https://www.rblbank.com/personal-banking/cards/credit-cards

- RBL Bank customer service: https://www.rblbank.com/contact-us