In the realm of personal finance, money market funds serve as a safe and liquid option for storing cash while earning modest returns. Among the various money market funds offered by Vanguard, VMFXX and VMRXX stand out as two popular choices. Both funds provide investors with a low-risk, stable investment option, but they exhibit distinct characteristics and underlying investment strategies. Understanding the nuances of VMFXX and VMRXX empowers individuals to make informed decisions regarding their cash management strategies.

VMFXX: A Federal Money Market Fund for Everyday Cash Needs

VMFXX, the Vanguard Federal Money Market Fund, is a traditional money market fund that primarily invests in highly liquid, high-quality U.S. government securities, such as Treasury bills and repurchase agreements. These securities offer a high degree of safety and stability, making VMFXX a suitable option for everyday cash management and short-term savings goals.

Key Features of VMFXX:

High Liquidity: VMFXX offers daily liquidity, allowing investors to easily access their funds without penalty.

Low Risk: VMFXX invests in highly rated U.S. government securities, minimizing credit risk.

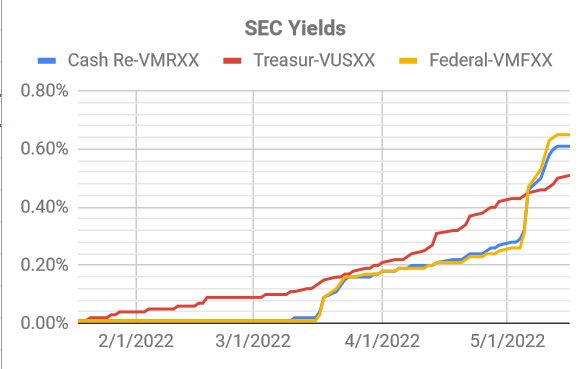

Stable Returns: VMFXX typically provides stable returns that closely track the prevailing federal funds rate.

VMRXX: A Cash Reserves Federal Money Market Fund for Enhanced Yields

VMRXX, the Vanguard Cash Reserves Federal Money Market Fund, is a more aggressive money market fund that invests in a broader range of securities, including U.S. government securities, municipal securities, and certificates of deposit. This diversification strategy aims to achieve higher yields compared to traditional money market funds, but it also carries slightly higher credit risk.

Key Features of VMRXX:

Potential for Higher Yields: VMRXX’s diversified investment strategy may offer higher returns compared to traditional money market funds.

Moderate Risk: VMRXX’s investment strategy carries slightly higher credit risk compared to traditional money market funds.

Daily Liquidity: VMRXX offers daily liquidity, allowing investors to easily access their funds without penalty.

Comparing VMFXX and VMRXX: A Side-by-Side Analysis

The table below summarizes the key differences between VMFXX and VMRXX:

| Feature | VMFXX | VMRXX |

|---|---|---|

| Investment Strategy | U.S. government securities | Diversified portfolio of U.S. government securities, municipal securities, and certificates of deposit |

| Risk Profile | Low risk | Moderate risk |

| Potential Returns | Lower returns | Higher potential returns |

| Suitability | Everyday cash management, short-term savings goals | Investors seeking higher yields, willing to accept slightly higher risk |

Choosing the Right Money Market Fund: Aligning with Individual Needs

The choice between VMFXX and VMRXX depends on individual risk tolerance and investment objectives. For investors seeking the utmost safety and stability for their cash holdings, VMFXX remains a compelling option. For investors seeking the potential for higher returns and willing to accept slightly higher risk, VMRXX may be a more suitable choice.

Conclusion: Navigating the World of Money Market Funds with Confidence

VMFXX and VMRXX both offer valuable options for managing cash and achieving modest returns. Understanding the distinct characteristics and risk profiles of these two funds empowers individuals to make informed decisions that align with their financial goals and risk tolerance. Whether seeking a safe haven for everyday cash needs or pursuing the potential for higher yields, both VMFXX and VMRXX serve as reliable tools in the realm of personal finance.