In today’s fast-paced world, managing finances effectively can be a daunting task. Juggling multiple accounts, tracking expenses, and setting financial goals can be overwhelming, making budgeting apps a valuable tool for individuals seeking financial clarity and control. Two popular budgeting apps, YNAB (You Need a Budget) and Mint, have gained widespread recognition for their ability to help users take charge of their finances. However, with both apps offering a range of features and benefits, it’s essential to understand their key differences to determine which one aligns best with your financial needs and preferences.

YNAB: A Zero-Based Budgeting Approach

YNAB stands out for its unique zero-based budgeting approach, which encourages users to assign every dollar they earn to a specific category, ensuring that every dollar has a purpose. This method promotes mindful spending and prevents overspending by requiring users to allocate their income before expenses occur. YNAB’s interface is designed to facilitate this approach, providing a clear overview of allocated funds and remaining balances.

Mint: A Comprehensive Financial Overview

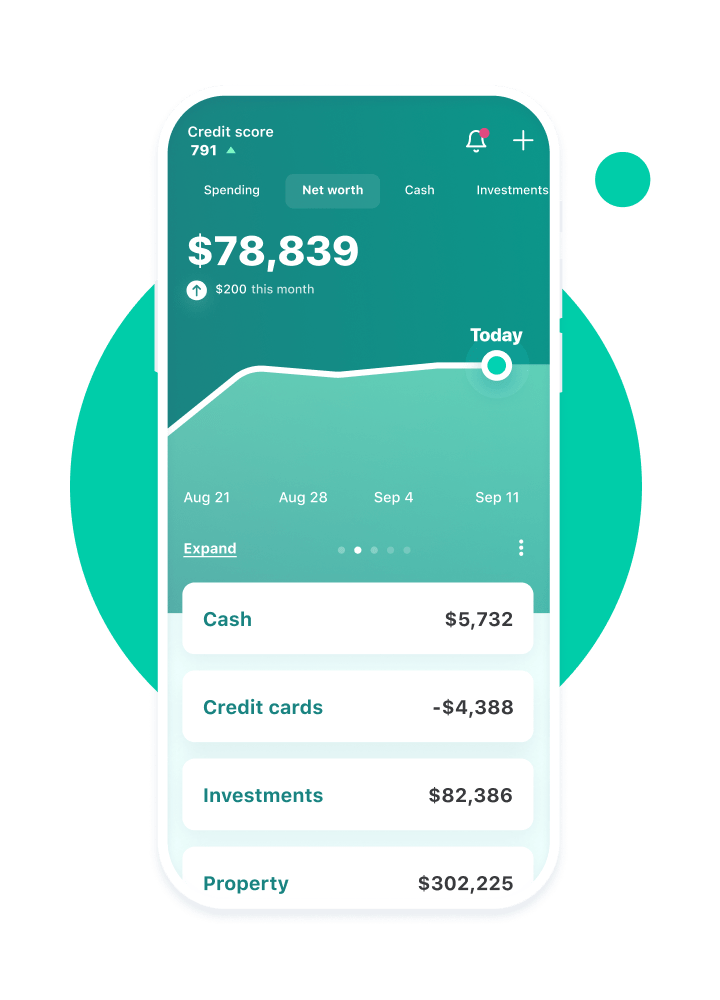

Mint, on the other hand, adopts a more comprehensive approach to financial management. It aggregates data from various financial accounts, including bank accounts, credit cards, and investment accounts, providing a holistic view of one’s financial standing. Mint automatically categorizes transactions, generates spending reports, and tracks net worth, offering a complete financial snapshot.

Key Differences in Features and Functionality

Budgeting Method: YNAB’s zero-based budgeting approach requires active participation in allocating funds, while Mint’s automated categorization and tracking provide a more passive overview of spending habits.

Goal Setting: YNAB offers robust goal-setting features, allowing users to set specific financial targets and track progress towards achieving them. Mint’s goal-setting capabilities are more limited.

Debt Management: YNAB provides detailed debt management tools, enabling users to track debt balances, visualize repayment progress, and create debt payoff strategies. Mint’s debt management tools are less comprehensive.

Account Linking: YNAB connects to a wide range of financial institutions, while Mint supports a broader range of accounts, including investment accounts and retirement accounts.

Cost: YNAB requires a monthly or annual subscription fee, while Mint offers a free basic plan with ads or an ad-free premium plan for a fee.

Choosing the Right App for Your Needs

The choice between YNAB and Mint ultimately depends on your individual budgeting style and financial needs.

If you prefer a proactive, hands-on approach to budgeting and want to focus on achieving specific financial goals, YNAB is a suitable choice.

If you prioritize a comprehensive overview of your finances, appreciate automated tracking, and value the ability to monitor multiple accounts, Mint is a better fit.

Additional Considerations

Learning Curve: YNAB’s zero-based budgeting approach may require a steeper learning curve compared to Mint’s straightforward interface.

Customer Support: Both YNAB and Mint offer responsive customer support through various channels, including email, phone, and online communities.

Integrations: YNAB integrates with third-party financial tools, while Mint offers a limited number of integrations.

Conclusion

YNAB and Mint stand as valuable tools for individuals seeking to manage their finances effectively. YNAB’s zero-based budgeting approach promotes mindful spending and goal-setting, while Mint offers a comprehensive overview of one’s financial standing and automated tracking. The choice between the two depends on your budgeting style, financial needs, and preferences. Ultimately, both apps aim to empower individuals to take control of their finances and achieve financial well-being.